Hello Guy’s, This is Ravi Verma, and I want to say, how to file Non-GST invoices In the GST portal in the case of GSTR-1

What is a Non-GST invoice?

The invoice in which our supplier has not paid the amount of GST or we have supplied goods/services to our vendor without levying GST, we call such invoice a non-GST invoice.

Filing steps:-

- Open your GST portal

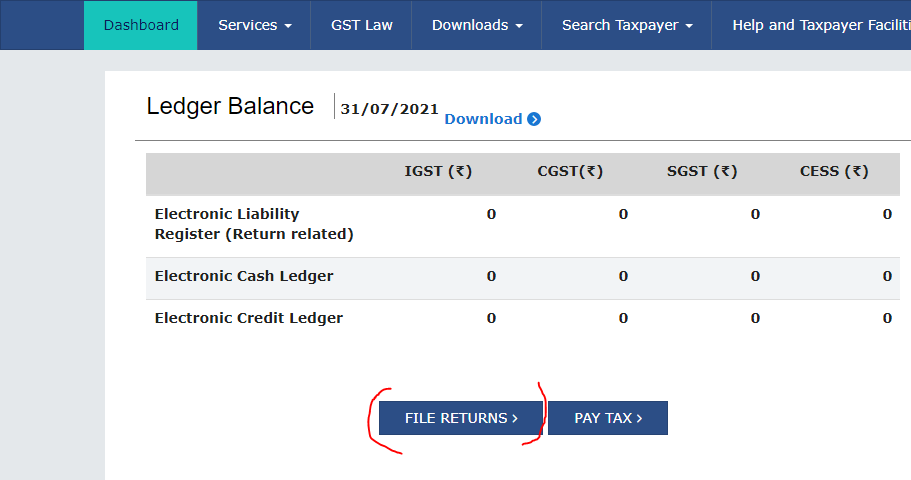

- Click on to the File return option.

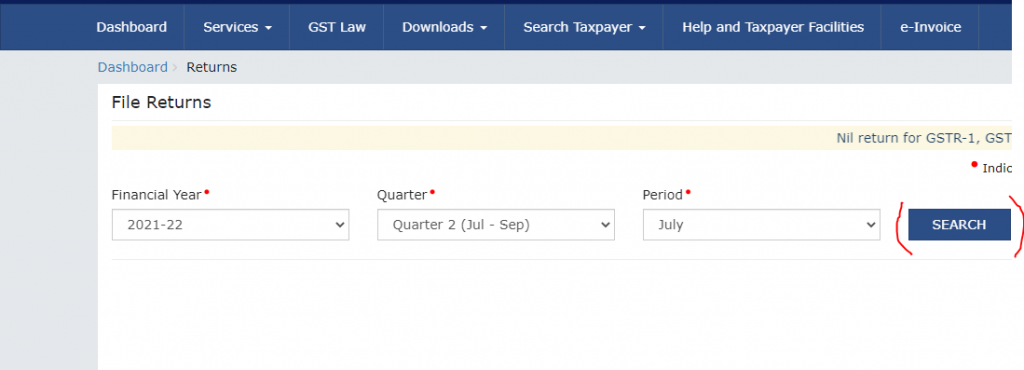

- Select your financial year, quarter and period and after doing that click on the search option.

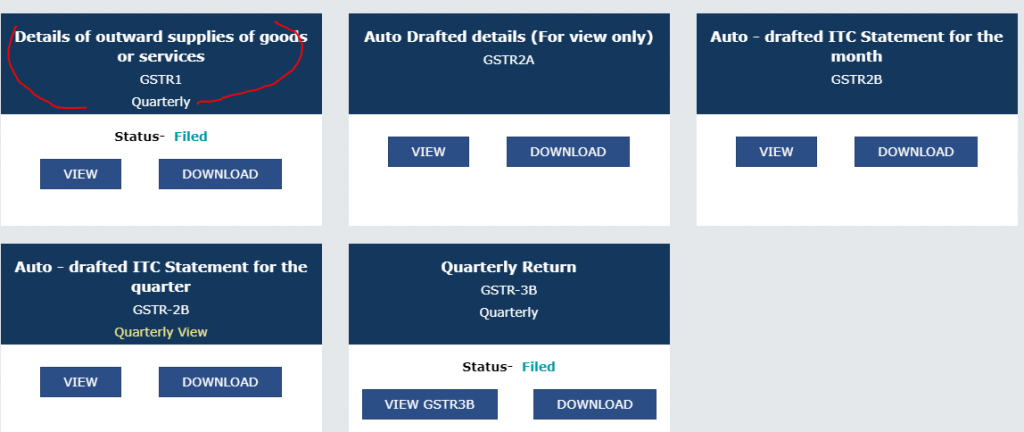

- After this process, you are entering in your GSTR column so, click the GSTR-1 option.

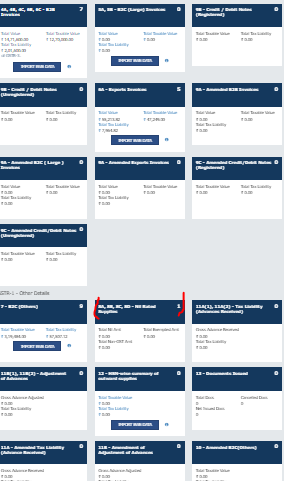

- Scroll down and go to GSTR-1 other details option and click on column number 8A, 8B, 8C, 8D-NIL Rated Supplies.

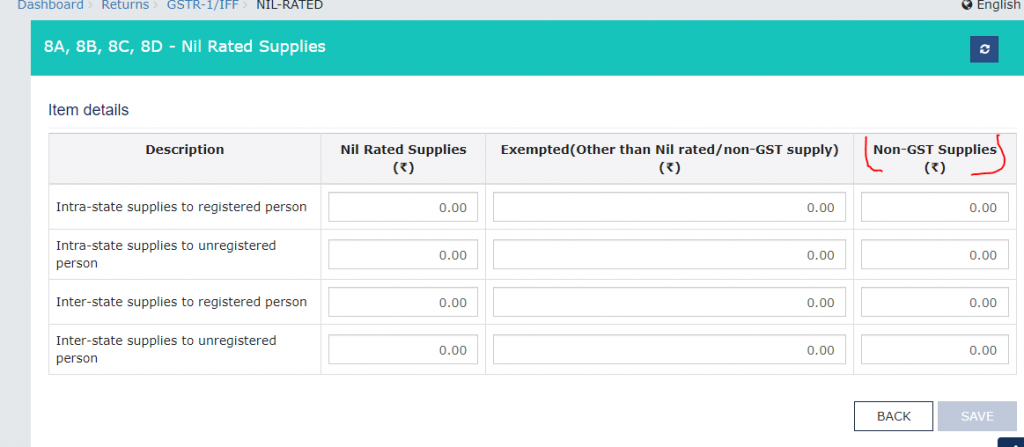

- Now you have to see the column number 8A, 8B, 8C, 8D – Nil Rated Supplies {Non-GST Supplies, Nil Rated Supplies & Exempted(Other than Nil rated/non-GST supply)}

Note points*******

- Intra-state supplies to registered person:- Select this column when you sell any non-GST goods/service to a registered person in the same state.

- Intra-state supplies to unregistered person:- Select this column when you sell any non-GST goods/service to an unregistered person in your state.

- Inter-state supplies to registered person:- Select this column when you sell any non-GST goods/service to a registered person in the other state.

- Inter-state supplies to unregistered person:- Select this column when you sell any non-GST goods/service to an unregistered person in other state.

Note point******* You have a Non-GST Invoice, please go to the Non-GST column and enter the amount of Whatever goods/services you have provided.

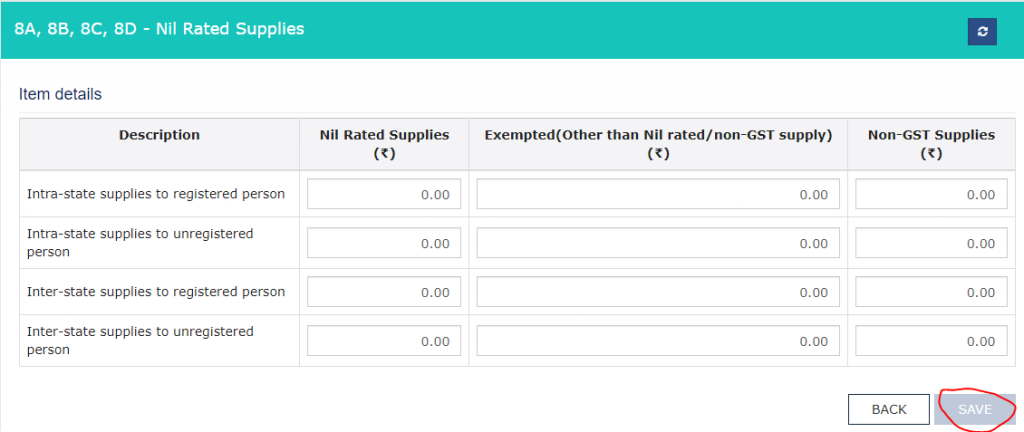

- The last step is to click on the save icon and finally, your non-GST invoice has been save in column GSTR-1.

Thanks,